Welcome Dr. Yerington to “I’ve got skin in the game” podcast. This is the second half of Dr. Yerington’s podcast. Dr. Yerington was a practicing anesthesiologist when a career ending disability occurred.

Dr. Yerington spends time discussing the disability insurance maze that he hopes no one else has to endure. He also will help you determine if a policy is a good policy for you. We discuss the differences between individual and group policies and what you need to know.

Dr. Yerington has five criteria for a good disability policy:

1. Use post tax dollars to pay for the policy

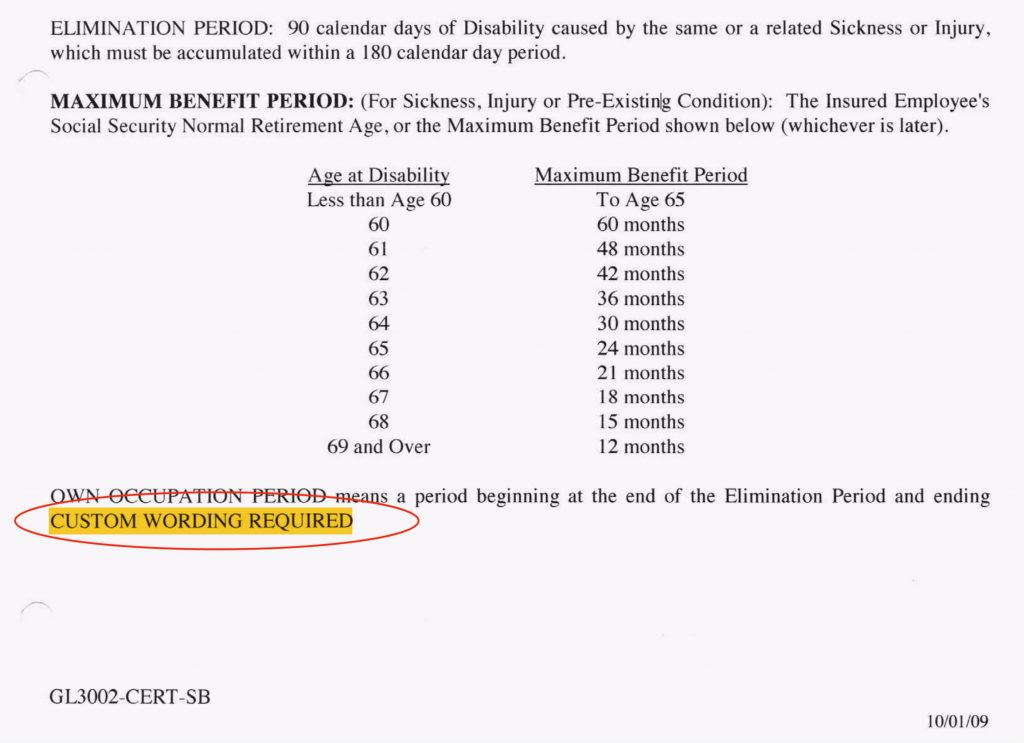

2. Own occupation is a necessity

3. Guaranteed renewable or a noncancellable policy

4. Have the option to increase in the future

5. Know your policy riders

There are certain life events that will cause you to reevaluate your disability insurance. Here are common times to look at disability insurance: Entering medical school, prior to first pregnancy if you are a woman, prior to residency, at the end of residency, any time you change jobs and/or states of employment. In your individual policy parameters should not change from year to year. Your group policy parameters will change from year to year.

In regards to life insurance, prior to becoming financially independant, Dr. Yerington recommends having life insurance for 20 times your annual gross income. Do you have a spouse that does not work? They also need to have great life insurance. Be a habitual saver – find out how this helped Dr. Yerington stay in his own home during the ups and downs of his early journey through disability.

His goal in life is to help physicians protect their most important assets so when they go to work, they know their home and family are taken care of – and they can concentrate on giving their best to patients and society without burning out.

You can contact Dr. Yerington these ways:

Dr. Christopher Yerington: https://www.linkedin.com/in/chrisyerington/